The Growth Illusion

For decades, FMCG and QSR growth has been equated with scale: more stores, more SKUs, more campaigns. But in today’s volatile consumer economy, pushing “more” no longer guarantees more returns.

Margins are under pressure. Shelf-space is fragmented. Consumer loyalty is fickle. Operational complexity multiplies with each new channel or SKU. And rising input costs (raw materials, labour, utilities) squeeze profits.

The truth? Growth doesn’t lie in expansion alone. It lies in clarity—knowing what to double down on, what to prune, and what to keep laser-focused on.

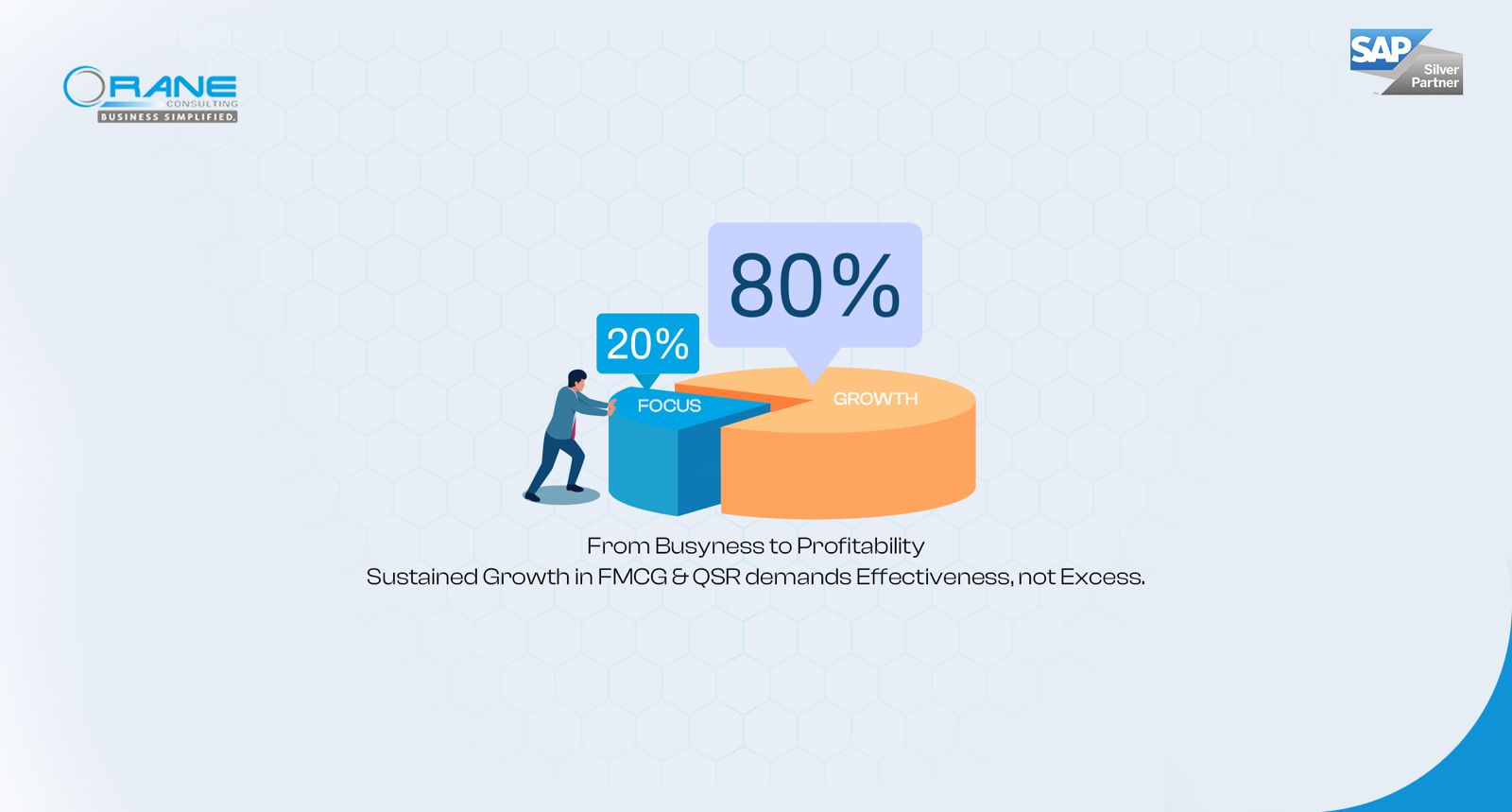

The 80/20 Rule in Action

The Pareto Principle has a simple, yet profound message: 20% of inputs deliver 80% of outcomes.

In FMCG and QSR contexts, this plays out as:

- A small subset of SKUs pulling in the bulk of margin contributions.

- A few customer behaviors / choices (loyal repeat, value perception, convenience) determining long-term retention.

- A core group of managers or stores whose performance sets the standard and influences culture across the network.

When leaders identify their own “20%”, they gain clarity, agility, and resilience.

In India, for example, NielsenIQ’s FMCG Quarterly Snapshot (Q2 2025) reported 13.9% growth in value vs the same quarter last year. Growth was driven largely by rural demand and urban recovery. Volume rose by ~6%, with price increases contributing as well. Small manufacturers are also gaining ground, showing that sometimes nimbleness in that “minority” can be a source of strength. NIQ

Also, NIQ’s Q1 2025 data showed that volume growth (5.1%) combined with price growth (5.6%) resulted in strong value growth, but smaller pack sizes were preferred — indicating consumers still demand value even in inflationary times. NIQ

Why Leaders Struggle

Knowing the 80/20 rule is one thing. Acting on it is quite another. Several gaps emerge in real Indian FMCG/QSR operations:

- Siloed data & delayed feedback loops — SKU performance, cost to serve, store execution metrics often live in different systems. By the time leadership sees the combined picture, weeks or months have passed.

- Too many priorities + shallow ownership — When every SKU is treated as critical, leadership attention gets thinly spread. Store operations, regional offices, marketing—all pushing their own “important” items.

- Cost pressures and margin invisibility — For QSRs in India, margins have been under pressure owing to rising raw material costs, rising delivery mix (expanding delivery platforms), and sometimes inability to raise prices due to demand sensitivity. For example, an Economic Times story pointed out that although aggregate sales for listed QSR chains rose ~10% in FY25 over FY24, margin expansion lagged due to operating costs and delivery mix rising. ETRetail.com

- Consumer behavior shifts — Urban vs rural dynamics, small-pack vs large-pack, offline/traditional vs modern trade vs online channels—all these make forecasting and execution harder without unified visibility.

How SAP-Powered Focus Enables Growth

Technology (especially platforms like SAP) can convert the 80/20 rule from theory into a repeatable discipline. Here’s how:

- Real-time SKU & Inventory Truth

Seeing which SKUs are selling fast, which are lagging, and which eat up capital in inventory without contributing margin. When businesses in India saw rural demand surging (as in NIQ Q2’25 data), being able to redirect inventory and promotion support to those regions made a difference. NIQ - Cost Driver Transparency

Mapping lease costs, food or raw material inflation, labour costs per outlet, and delivery costs (especially when aggregators or delivery platforms add fees) to understand which stores or SKUs are truly profitable. - Demand Forecasting & Channel Insight

Integrated planning tools allow you to anticipate shifts — for example, changing preference toward non-food categories, or modern trade vs traditional trade. NIQ’s Snapshot indicated non-food categories are accelerating. NIQ - Performance and Culture Anchors

Identifying high performers — stores, managers, teams — who consistently deliver, then learning from them and replicating their practices. Ensuring SOPs, training, feedback loops are aligned with what the top 20% do. - Adaptive Packaging and Promotion Design

Because Indian consumers are very price sensitive, there is strong preference toward smaller packs or more affordable SKUs when prices rise. NIQ reported that in Q2’25, value growth was strongly driven by smaller pack sizes. NIQ

Orane Consulting’s Perspective

At Orane, we’ve seen these patterns play out in real time with Indian clients. We are not just talking about theory; we work closely with FMCG brands and QSR chains to help them:

- Streamline SKU portfolios to focus on those that deliver majority margins and growth.

- Set up data-pipelines that combine sales, supply-chain, cost, execution into a unified dashboard.

- Build leadership alignment around that 20% — so that operations, marketing, finance all focus together.

Through our CustomerXverse Sessions, we simulate these scenarios: we bring your own data, run through what your 20 % might be under different levers (SKU rationalization, channel focus, cost reduction), show live SAP-based dashboards, and help you walk away with clarity and an action plan.

The CXO Takeaway

The world isn’t getting simpler. Inputs are more expensive. Consumer preferences more volatile. But the fundamental lever still stands: focus beats scale when scale is unfocused.

If you had to boil growth strategy down to one question this year as a CXO, make it this:

Which 20% of my SKUs, customer segments, store network, cost structure are contributing to 80% of my margin and growth — and am I investing in them properly?

Because when you answer that, everything else (processes, investments, culture) aligns more naturally.

CTA: Book a Consultation with Orane Consulting to discover how your 20% can define the future of your growth in India’s unique FMCG / QSR environment.

References

- NielsenIQ, India’s FMCG market remains resilient and is poised for growth in 2024 (Outlook report) — India forecasted at 4.5-6.5% growth. NIQ

- NielsenIQ, Rising FMCG rural growth underpinned by stable consumption in India, Q1 2024 snapshot — 6.6% value growth, rural areas surpass urban in growth. NIQ

- NielsenIQ, India’s FMCG industry achieved 13.9% value growth in Q2’25 vs corresponding quarter, with rural markets leading. NIQ

- NielsenIQ, FMCG growth momentum shifts: rural India and small players take charge, Q1’25 report. NIQ

- Economic Times, QSR firms’ margins under pressure as food delivery mix increases — report on Indian QSR chains in FY25. ETRetail.com

- NIQ Shopper Trends 2024 Report, India — insights into price sensitivity, smaller pack preference, promotional influence. NIQ